StructureFlow Spotlight: Project Finance

Project finance relates to the financing of major projects such as the building of energy or public infrastructure - for example the building of a new wind farm which might cost upwards of $500m.

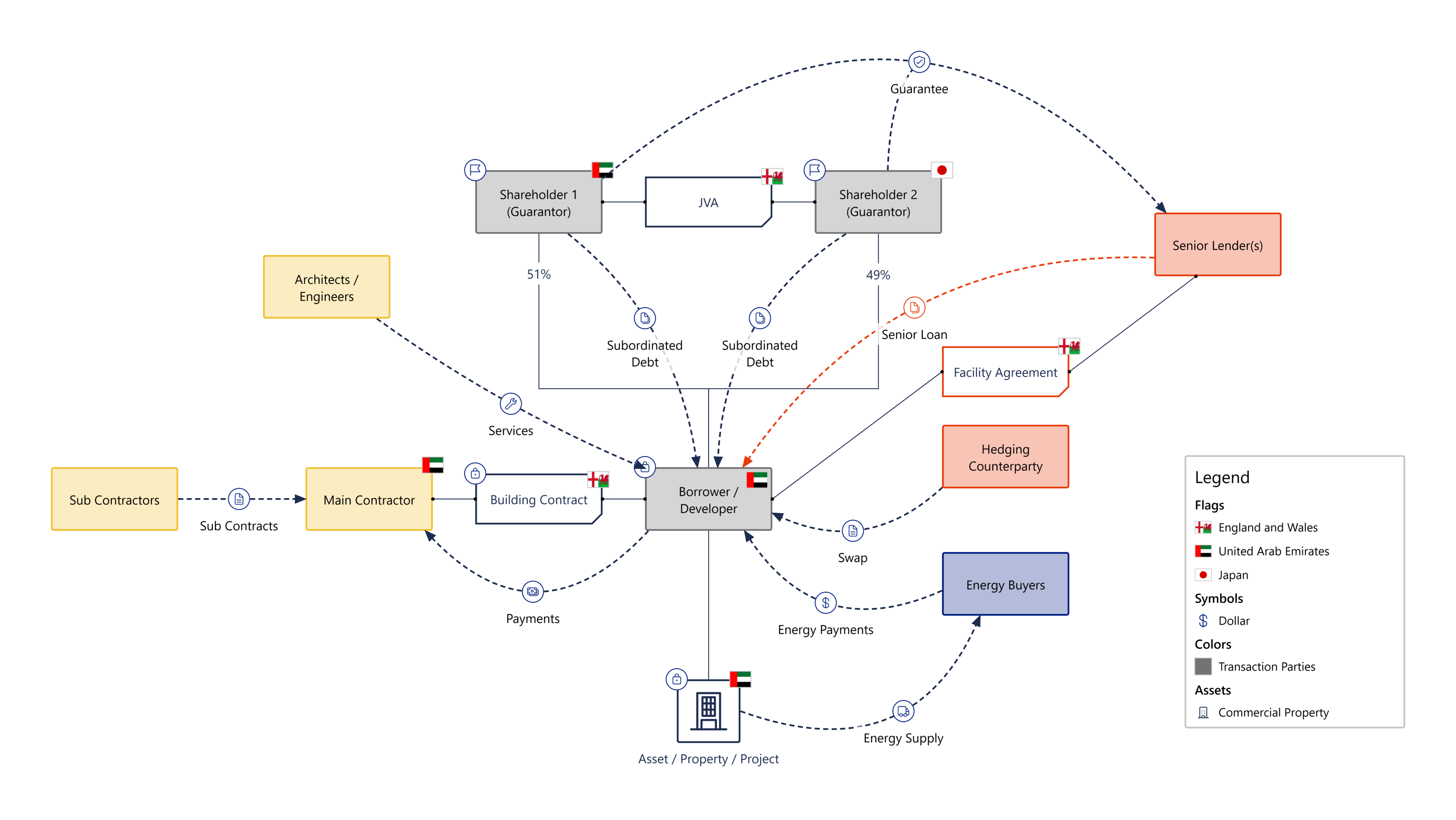

These projects are often extremely complex. They involve a range of negotiations with a wide range of organisations that are party to many different types of contracts relating to the financing or construction of the project. Taking our wind farm example, there will be a huge number of contractors and sub-contractors lined up for the construction, multiple parties providing finance of different types, and energy companies committing to take energy when production finally starts.

Visualization is critical to ensure that the teams and teams of people involved in the project across multiple organisations understand exactly what's needed and to work efficiently. StructureFlow can be used to unpack the complexity, explain the structure and help advisers to foresee risks of different types.

Watch our client success story videos to hear directly from the teams at Norton Rose Fulbright, Slaughter and May, and Burness Paull.

Our team will work with you to ensure a similarly seamless and successful implementation of StructureFlow.