We’re delighted to announce today, that we’ve closed a USD 6 million Series A funding round. The investment will enable us to further leverage artificial intelligence to accelerate our product development and grow our international presence to meet booming global demand.

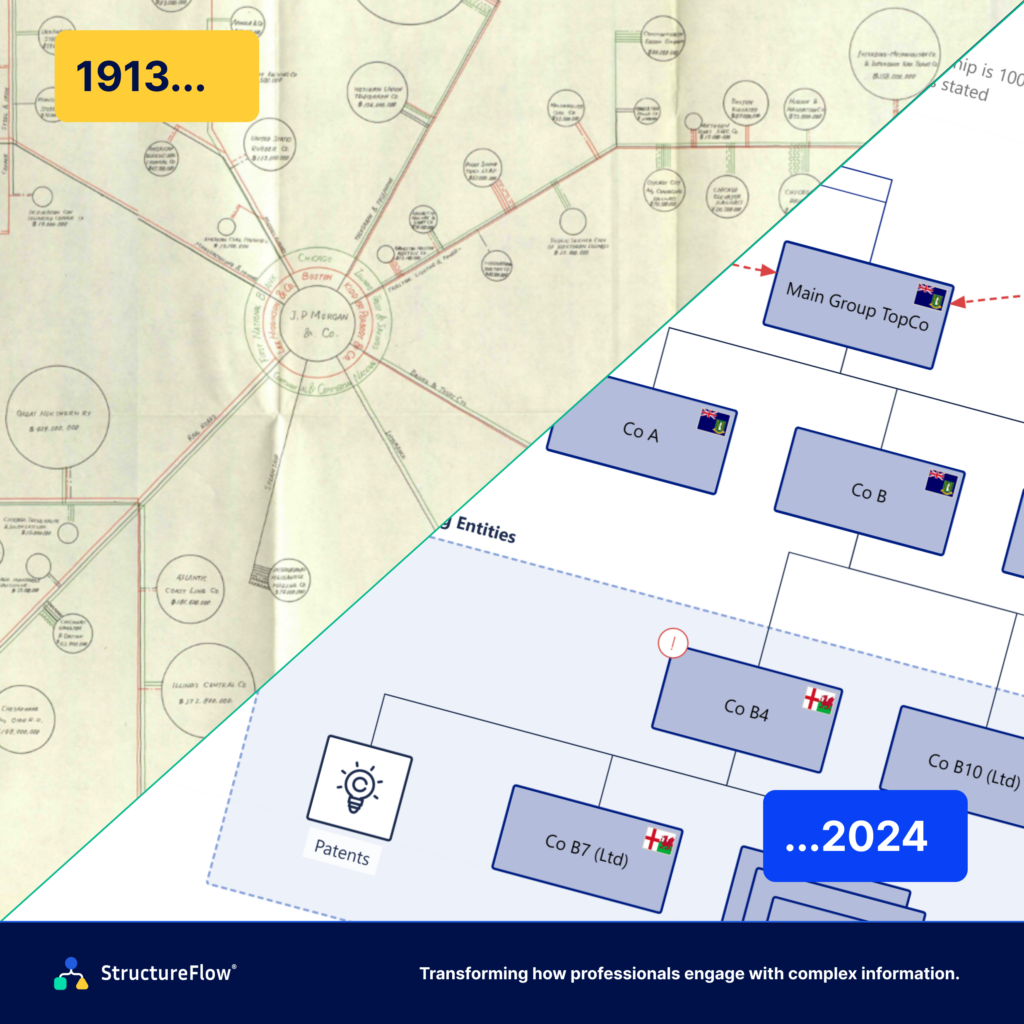

Visualizing corporate structures and transactions is critical for busy legal and finance professionals trying to cut through the complexity of intricate corporate relationships. From the first mapping of J.P. Morgan’s structure in the early 20th century to the recent dismantling of FTX’s collapsing crypto empire, structure charts have consistently served as integral tools to see the big picture, enabling teams to work through the legal, financial and regulatory detail to find the best outcomes for their clients.

Until now, creating these charts has been hugely painful and time consuming – involving an analogue ‘diagraming’ workflow that hasn’t changed in decades. Enter StructureFlow. Founded by Tim Follett, inspired by his experience at prestigious UK law firm Slaughter and May, the company entirely digitizes the workflow, moving beyond simplistic diagraming and unlocking the power of visual working for 21st century professionals.

Today, our platform is used by over 50 major legal and professional services firms worldwide. Customers include prominent Am Law 100 firms Baker McKenzie, Bryan Cave Leighton Paisner and Norton Rose Fulbright, as well as British ‘Magic Circle’ firms Slaughter and May, A&O Shearman and Linklaters.

Our highly experienced global team take a data-centric approach to the visual modelling of complex corporate information. With a mission to create clarity from complexity, StructureFlow goes “beyond diagramming” – combining artificial intelligence with flexible drawing tools to ingest complex information like contracts, datasets and public records and automatically visualizing the content. Users can generate data-driven visual models in seconds that can be dynamically manipulated for the exact purposes of the project at hand – whether a corporate acquisition, debt restructuring or regulatory investigation etc.

“Legal and professional services around the world are feeling the strain from decades of economic, technical and social upheaval and are crying out for change. As both a former attorney and former operator of technology scale-ups myself, I was struck by the clarity of Tim’s vision for StructureFlow, and the quality of the team that he has built around him to deliver on the promise of cutting through complexity. Change is coming to this industry, and Tim and his team, with their deep expertise across legal, SaaS and legal tech, are extremely well placed to deliver it.”

Chris Haley, Partner at FINTOP Capital

“As a former corporate attorney, I experienced firsthand the power of visualization in cutting through complexity. A picture really is worth a thousand words! Yet, creating these visuals was often deeply painful and frustrating, especially late at night, stressed, spending hours moving shapes and lines in PowerPoint. There had to be a better way, and I felt compelled to find it. Our mission is to unlock the power of visualization, making it incredibly easy to generate visual content. With the advent of GenAI, there’s never been a better time to leverage this opportunity. Our goal is to transform how professionals communicate complex information, making it faster, more efficient, and far less stressful.”

Tim Follett, CEO & Founder of StructureFlow

About FINTOP Capital

FINTOP Capital is a venture firm focused on early-stage, B2B fintech companies. With $700 MM+ in committed capital across five funds, the team has decades of industry experience as entrepreneurs, operators, & investors. FINTOP invests in the next generation of operators, those changing the way our financial institutions and their customers move, track & interact with money.

About Venrex

Venrex is a UK-based venture capital firm that backs creative Founders to launch and build innovative businesses.